Digital & Social Media Marketing

We help you make a big impact when entering a new market, by pulling from our database of tried and proven social media influencers in the health, nutrition, mom & babies, skincare, cosmetics, personal care, food, functional food and related sectors. We’ll deploy the right influencers at the right time, on the right platform with the right message - to make sure your message has the greatest reach possible.

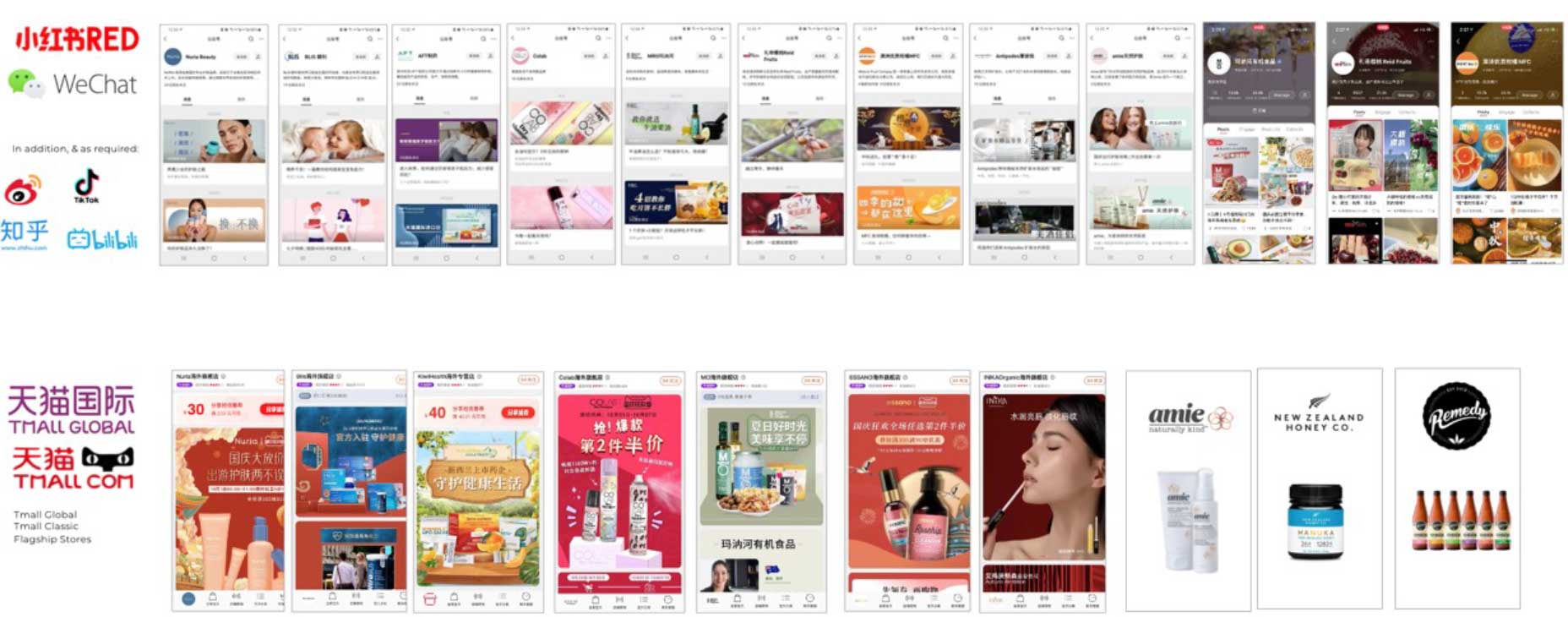

Brand Activation & eCommerce Asset Creation

We activate your brand, set up your online stores, and provide full product, marketing, and sales support across a variety of eCommerce platforms. From marketplaces and flash sales to search engines, social media, and review sites, we ensure your brand is optimised for maximum visibility and engagement on the most relevant channels for your target market.

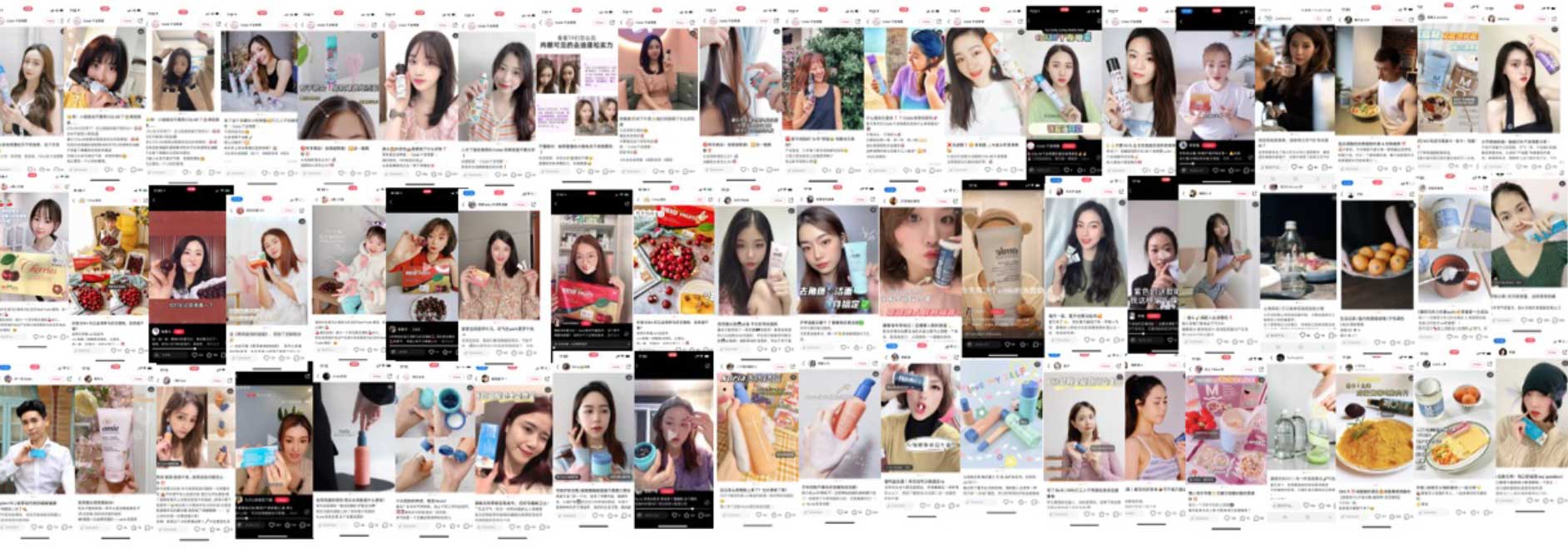

Influencer Brand Activation

We develop User-Generated Content (UGC), Key Opinion Leader (KOL), and Key Opinion Consumer (KOC) campaigns using carefully selected social media influencers from your industry. Our approach ensures that your message resonates at all levels, driving engagement and brand loyalty.

Live Streaming

We’re always on top of social media trends. With live streaming becoming more and more popular, and an important way to demonstrate authenticity to consumers, we make sure to utilise this format - and all trending formats - when appropriate.

Are you ready to unlock a world of potential?

Take the first step towards global expansion. Fill out RLG’s pre-qualification survey and schedule a tailored consultation to discover how we can help you succeed internationally.