We’re the New Markets Cross-Border eCommerce Experts

If you're looking to expand your business into new international markets, we can help.

We are experts in Cross-Border eCommerce, with extensive experience helping foreign companies enter and thrive in various global markets including China, India, Singapore and the USA. Our firsthand knowledge of each region's regulatory landscape, distribution channels, and evolving consumer preferences ensures smooth and successful market entry.

From product registration to inventory management, warehousing, shipping, and even after-sales support, we handle every aspect of the digital sales process. We’ll also ensure you’re set up on the right eCommerce platforms to effectively reach your target customers.

The right CBEC channels

We set you up on the ideal mix of Cross-Border eCommerce channels, from marketplaces to group buying platforms; ensuring you reach the right consumers, boost awareness, and drive sales.

CBEC Payments & Shipping

Cross-Border logistics & Warehousing

Social Commerce

RLG’s in-house team excels at influencer-driven campaigns using both Key Opinion Leaders (KOLs) and Key Opinion Customers (KOCs). We handle content creation, multi-channel marketing, and promotions for major shopping events like Singles Day, Black Friday and Cyber Monday, ensuring maximum brand visibility and sales growth across social platforms in new markets.

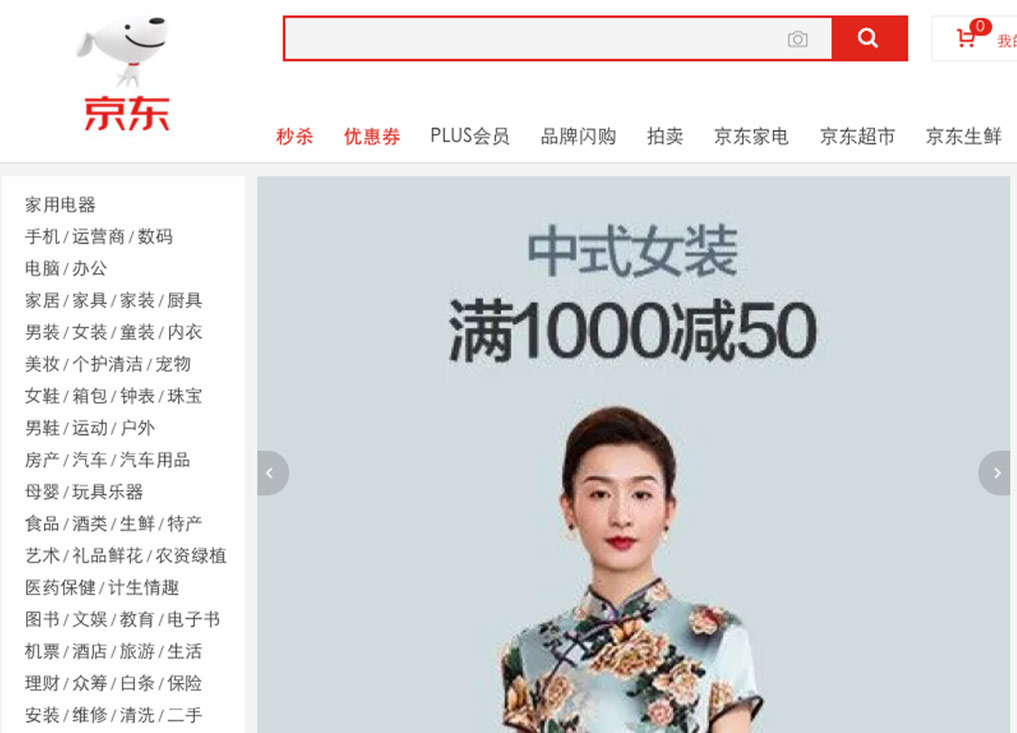

Direct sales to CBEC platforms

RLG provides product, marketing, and sales support to the direct-sales departments of major cross-border eCommerce platforms. This includes leading platforms like Tmall Global, HKTV Shop, JD Worldwide, JioMart and others, ensuring your products are effectively positioned to reach international consumers.

Domestic eCommerce Solutions

Is your product ready for general trade registration and regular over the counter (OTC) retail sale & distribution? RLG has extensive experience in registering goods for domestic eCommerce platforms worldwide, supporting seamless integration for both online and offline distribution.

CBEC Case Studies

We’ve helped dozens of brands successfully enter and grow in new international markets. Explore our cross-border eCommerce case studies to see the full range of what we can offer.

Browse Our Success Stories

Are you ready to unlock a world of potential?

Take the first step towards global expansion. Fill out RLG’s pre-qualification survey and schedule a tailored consultation to discover how we can help you succeed internationally.